The vote on 23 June 2016 in favour of the UK leaving the EU took many politicians and media representatives by surprise. The polls showed a clear lead for Remain supporters (no exit) for many months. However, the Leave camp (in favour of leaving) gained support. Even I was surprised that it was enough in favour of leaving in the end. I assumed that the result would be close, as in the Scottish referendum in autumn 2014. However, I personally never believed in a Brexit.

Leaving a community always means an increase in uncertainty. But as with a broken marriage, sometimes the opportunities in breaking up a union seem greater than the disadvantages. Whether this is really the case is always only known afterwards. And that is precisely what makes for uncertainty.

The financial markets reacted immediately. While the pound had been strengthening since 2013, making our whisky more expensive, the pound plummeted hugely after the result was announced. But it was not as bad as the press reported. It is still moving at exchange rates to the euro that we last saw in 2013. Falling exchange rates always mean a hindrance to imports. It becomes more expensive for Britain to buy goods from abroad. In return, exported goods, like our whisky, become cheaper in the target markets. You can export on better terms. A falling pound should help British exports significantly.

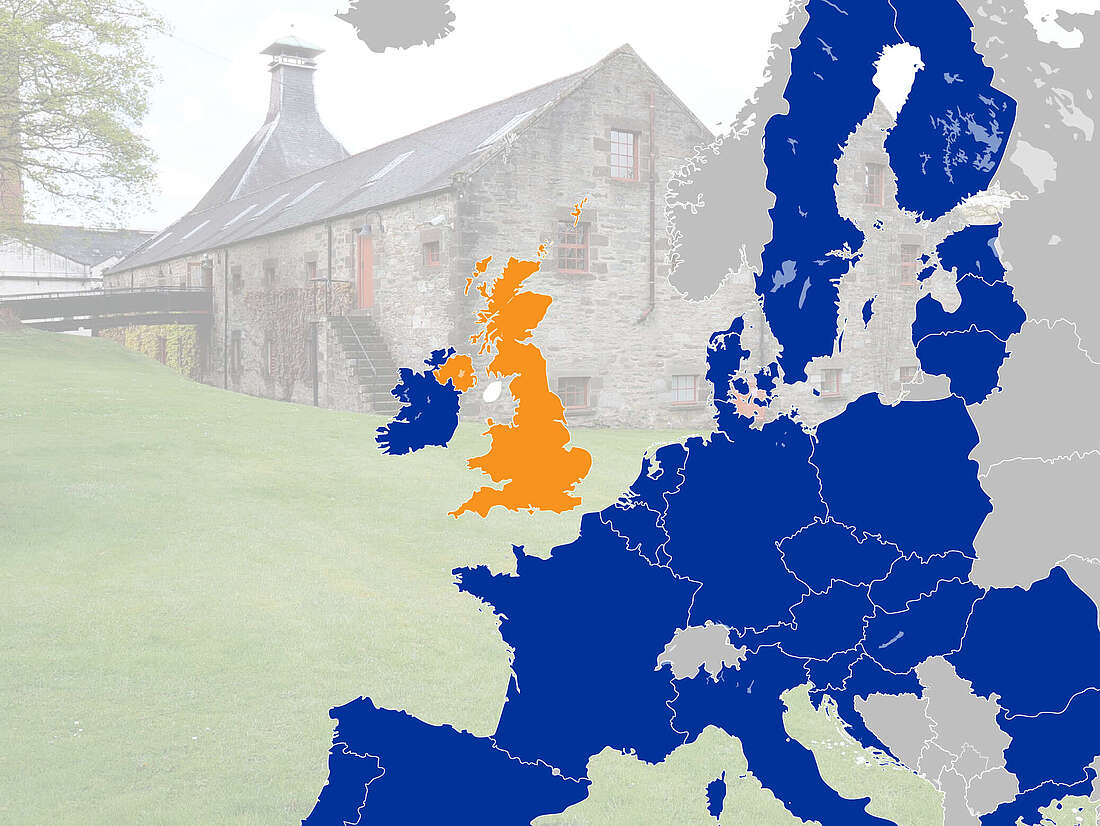

Now comes the big question of tariffs. Will the EU impose tariffs, and on Scotch whisky in particular? It's a fair question, because quite a few people in charge in Brussels are pissed off and will probably want to make an example. But when a country has a tariff 'imposed' on it by a trading partner, it is a double-edged sword. For the disadvantaged country will in turn impose import duties on the imported goods. And at this point it is worth taking a look at the European trade balances. And here we have found a negative balance in the UK for more than a decade. Currently it amounts to -150 billion euros. And the most important exporting country in the EU is Germany with a surplus of 250 billion euros. Britain imports goods worth 90 billion mainly from Germany, followed by the Netherlands, France, Belgium and Italy. On these, Britain would also impose tariffs. And that hurts the EU more than the UK, as the UK's trade balance is negative. So the likelihood of tariffs on our whisky is small.

There is a figure in the literature of 550 EUR per hectolitre (1 hl = 100 litres) of pure alcohol as excise duty in the EU. This has nothing to do with customs duties. This is a value for the member states as to what the minimum level of excise duty should be in a country. Germany is at 1,303 EUR per hl of pure alcohol. Whisky is delivered to each country exempt from domestic excise duty. Only there does each country add its own excise duty to the whisky. As this excise duty is levied by the customs authorities, misunderstandings often arise here.

In the next two years (more likely three years), the EU will negotiate the exit with the UK and conclude corresponding trade agreements. There are a few examples. Norway, for example, is part of the European Economic Area (EEA). With Switzerland, on the other hand, there are a lot of bilateral agreements. Canada has negotiated the CETA agreement with the EU and Turkey and the EU are in a customs union in which no customs duties are levied. What all these agreements have in common is a far-reaching reduction or avoidance of tariffs to promote trade. And these will also apply to our whisky. After all, after oil, whisky is one of Britain's biggest exports. But even if tariffs were imposed. On average, these amount to between 2.5-3.5% for imports into the EU. Nothing that could not be compensated for by a weaker pound exchange rate.

Currently, import prices for whisky are falling because the pound has fallen and the UK is still in the EU. But the difference will not have an immediate positive effect on our whisky price. As the majority of goods only move between branches of corporations, their internal fixed conversion rate comes into play. This is an important internal financial parameter. You don't like to change it, because then the automatic internal accounting would become much more complicated. Typically, this rate is only adjusted annually. Within a year, nothing would have to happen to our whisky prices for these reasons.

However, cautious people should stock up on their whisky very soon. Changes always mean risks. On the other hand, customers who are willing to take risks can wait a while, because a further decline in the exchange rate offers the opportunity for price reductions.

I myself am not too worried about the Brexit. The people in the UK are just as nice as in Germany. And nice people always find each other to trade with. Because prosperity only comes from trade. And based on that, we can enjoy each other's fruits of our labour. For us, that is whisky.

Addendum Autumn 2023 by Horst Lüning

On 31 January 2021, the Brexit finally took place. However, the great irritation caused by changed trade processes did not take place. Nevertheless, the delays in deliveries amounted to several weeks. Since all this was known, we at Whisky.de were able to fill our stocks with a safety buffer beforehand. This is exactly what importers and distributors did as well, so that the feared 'big supply crisis' did not occur.

However, some bottles were in short supply and the increased bureaucracy also led to additional costs that had to be passed on to the prices. 2021 was then also the year in which food inflation then rose noticeably to values around 5%. However, this had less to do with Brexit than with higher energy prices. Over the years 2022 and 2023, food inflation continued to rise to 15% to 20% per year. Fortunately, this trend only partially affected our whisky. You can still find high-quality whiskies whose prices have changed little or not at all compared to 30 years ago.